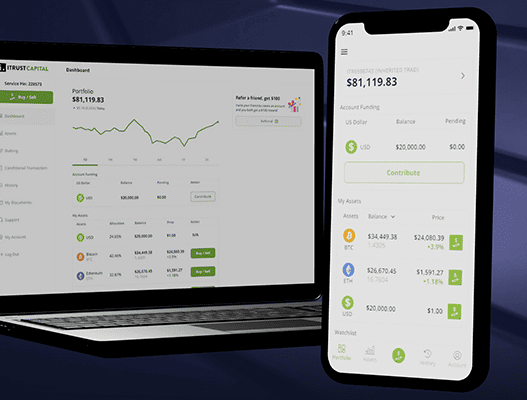

Both iTrustCapital and Bitcoin IRA allow you to invest in cryptocurrency through a self-directed IRA held with a qualified custodian. They're two of the most popular options featured in my guide to the best crypto IRA accounts.

While they offer similar benefits on the surface, each platform differs significantly. Understanding those differences is key to choosing the right one for your situation.

This guide starts with a quick comparison table of the core details, then explains why those differences matter and which type of investor each platform is best for.

While both companies offer additional features, this comparison centers on their core self-directed crypto IRA and other tax-advantaged products.

Sections include:

iTrustCapital vs Bitcoin IRA: Key Facts

| Feature | iTrustCapital | Bitcoin IRA |

| Account Minimum | $1,000.00 | $1,000.00 |

| Minimum Transaction Amount | $20.00 | $10.00 |

| Available IRA Types | Roth, Traditional, and SEP IRA | Traditional, Roth, SEP, and SIMPLE |

| Staking Support | Yes – SOL staking available inside IRAs (more coming soon) | Yes — supports Ethereum, Cardano, and Solana (Polkadot coming soon). |

| Custody | Assets are held with a qualified custodian through iTrust Custodial Services, which partners with Fortis Bank and uses institutional-grade storage solutions from providers like Coinbase Custody and Fireblocks. | Assets held with Digital Trust LLC, a regulated Nevada-chartered trust company |

| Market Access | 24/7 access to the markets | 24/7 access to the markets |

| Setup Fees | None | 1.99% of incoming funds |

| Transaction Fees | 1% transaction fee (plus the bid-ask spread) | 2% trade fee (includes all transaction costs, including spread) |

| Fees – Maintenance | None | 0.08% monthly (minimum $20/month) |

iTrustCapital vs. Bitcoin IRA Fees: Which Platform Costs Less?

Key Point: iTrustCapital's flat 1% fee structure is more competitive and cost-efficient.

Analysis: Bitcoin IRA charges a 2% trading fee, a 1.99% account setup fee, and monthly maintenance fees starting at $20.

By contrast, iTrustCapital has no setup, monthly, or annual account fees. You'll pay a 1% fee per transaction, whether buying or selling.

iTrustCapital sources pricing from third-party liquidity providers, meaning there is a bid-ask spread built into the execution price. While iTrustCapital does not disclose exact spreads, third-party tests suggest that spreads on major cryptocurrencies like Bitcoin and Ethereum typically stay under 0.20%. Spreads may be wider on smaller, less liquid assets.

Bitcoin IRA states that its 2% trading fee includes all exchange-related costs, including spread and execution.

This might matter if you are planning to buy or sell lesser-known cryptocurrencies, since those tend to have wider spreads. But for most long-term investors who stick with major assets, the difference is usually minimal.

Realistically, actively trading riskier coins in a retirement account—where every trade costs you—is not a sound long-term strategy.

Read my full iTrustCapital review for a more detailed breakdown of how it works.

Can You Earn Interest or Staking Rewards with a Crypto IRA?

Key Point: Bitcoin IRA offers more staking options than iTrustCapital, but the added complexity, fees, and tax uncertainty make it a questionable fit for most long-term investors.

Analysis: Bitcoin IRA currently supports custodial staking for Ethereum (ETH), Cardano (ADA), and Solana (SOL). iTrustCapital has more limited options, having recently introduced staking for Solana, with more options expected soon.

| Feature | iTrustCapital | Bitcoin IRA |

| Assets Supported for Staking | Solana (SOL) only | ETH, ADA, SOL (DOT coming soon) |

| Fee on Staking Rewards | 22% net of fees (already deducted) | 30% (custodian) + 4–6% (Coinbase) |

If staking is your top priority, Bitcoin IRA does offer more options today. But there are significant trade-offs—especially inside a retirement account.

First, the costs add up quickly. Bitcoin IRA charges a minimum of $20 per month in account fees. To break even, you'd need to earn at least $240 per year in staking rewards—before factoring in trading fees or the platform's share of your staking yield.

For example, if Ethereum (ETH) yields 6% annually, Bitcoin IRA's combined staking fees—30% from the custodian and up to 6% from Coinbase—reduce your net return to around 3.84%. At that rate, you'd need to stake more than $6,250 in ETH just to cover Bitcoin IRA's monthly account fee.

Perhaps most importantly, there's still no clear IRS guidance on how staking rewards inside an IRA will be taxed. Custodial staking is generally seen as safer from a tax standpoint than running your own validator, which could trigger unrelated business income tax (UBIT). But that could change, and any shift in tax treatment could affect your long-term returns.

From a financial planning standpoint, staking can look attractive in the short term—but the risks, fees, and uncertainties often outweigh the benefits.

For most retirement investors, sticking with major assets and minimizing costs is a more reliable path to building long-term wealth.

Staking crypto inside an IRA isn't as straightforward as earning dividends from stocks. Both iTrustCapital and Bitcoin IRA offer custodial staking, where the platform handles the process on your behalf and rewards are credited to your IRA. This is different from direct node staking, where you run your own validator and could trigger unrelated business income tax (UBIT). Custodial staking is generally seen as safer from a tax standpoint, but the IRS hasn't provided definitive guidance, so treatment could change in the future.

What Types of Retirement Accounts Do iTrustCapital and Bitcoin IRA Support?

Key Point: Bitcoin IRA supports a broader range of IRA types, including Traditional, Roth, SEP, and SIMPLE IRAs. iTrustCapital currently offers support for Traditional, Roth, and SEP IRAs only.

Analysis: Bitcoin IRA does support SIMPLE IRAs, which are designed for small businesses and self-employed individuals who want to contribute as both employer and employee. This can be useful in certain cases, such as when a solo business owner wants to offer retirement benefits and invest in crypto.

Still, it's a relatively uncommon scenario. Most people looking to invest in crypto through a retirement account are doing so with a self-directed Traditional or Roth IRA. And while Bitcoin IRA references 401(k) plans on its site, it does not offer a way to open and fund a new 401(k). Instead, it helps you roll over an existing 401(k) into one of its supported IRA types.

Beyond retirement accounts, iTrustCapital also offers non-IRA crypto investing through its Premium Custody Account—a secure, U.S.-based account designed for everyday crypto trading with institutional-grade storage, 24/7 access, no monthly fees, and support for a wide range of assets. The platform also allows you to invest in precious metals like gold and silver. See our top-rated gold IRA providers here

Is iTrustCapital or Bitcoin IRA More Secure?

Key point: Both companies take security seriously.

Analysis: iTrustCapital secures client assets through Coinbase Custody and Fireblocks, two of the most trusted institutional custodians in the crypto industry. Assets are stored entirely offline in cold storage and cannot be moved without passing through multiple internal authorization steps.

There's no hot wallet access or direct connection to external wallets, which greatly reduces the risk of unauthorized withdrawals—even if login credentials are compromised.

Bitcoin IRA uses BitGo, another respected custodian, and promotes its use of multi-signature wallets, offline storage, and video verification for identity checks.

The platform is SOC 2 Type 2 certified, reflecting strong standards for data integrity and internal controls.

iTrustCapital vs. Bitcoin IRA: Which One Is Better for You?

For most investors, iTrustCapital is the better choice.

With no setup or monthly fees and a flat 1% transaction fee, it's one of the most cost-effective ways to invest in crypto for retirement.

In contrast, Bitcoin IRA's costs add up quickly: a 1.99% setup fee, 2% trading fee, and at least $240 per year in account fees. In the first year alone, those charges can exceed $700 on a $15,000 portfolio, compared to just $150 with iTrustCapital.

Even in Year 2, assuming a $5,000 contribution:

- Bitcoin IRA: ~$340 in fees

- iTrustCapital: ~$50

Bitcoin IRA does offer features iTrustCapital doesn't, like SIMPLE IRA support and staking for Ethereum and Cardano.

However, those are niche use cases.

For most long-term investors focused on Bitcoin, Ethereum, and similar assets, iTrustCapital's low-cost structure and simplicity make it a standout choice.

That said, if staking rewards or SIMPLE IRA access are priorities, Bitcoin IRA might be a better fit—just be sure the benefits outweigh the fees.

Visit iTrustCapital and get a $100 bonus when you sign up through this link.