Monarch Money currently offers a working promo code.

Enter MONARCHVIP to get 50% off your first year on the annual plan.

The regular price of $99.99/year is reduced to $49.99 for your first year, and you're only charged after your 7-day free trial ends.

The way this works is you first start your free trial, then apply the promo code inside your account settings — not on the initial signup screen. Here's what it breaks down to:

- Sign up for Monarch Money and begin your 7-day free trial.

- Go to Manage Subscription in your account and select the annual plan ($99.99/year).

- Enter the code MONARCHVIP in the promo code box and click Apply.

- Your price drops to $49.99 for the first year after the trial ends.

Key things to know:

- The code only works on the annual plan.

- You won't be billed until after the 7-day free trial ends.

- The promo code can be applied from both the app and desktop, but only after your account is created.

Why I Recommend Monarch Money (Personal Experience)

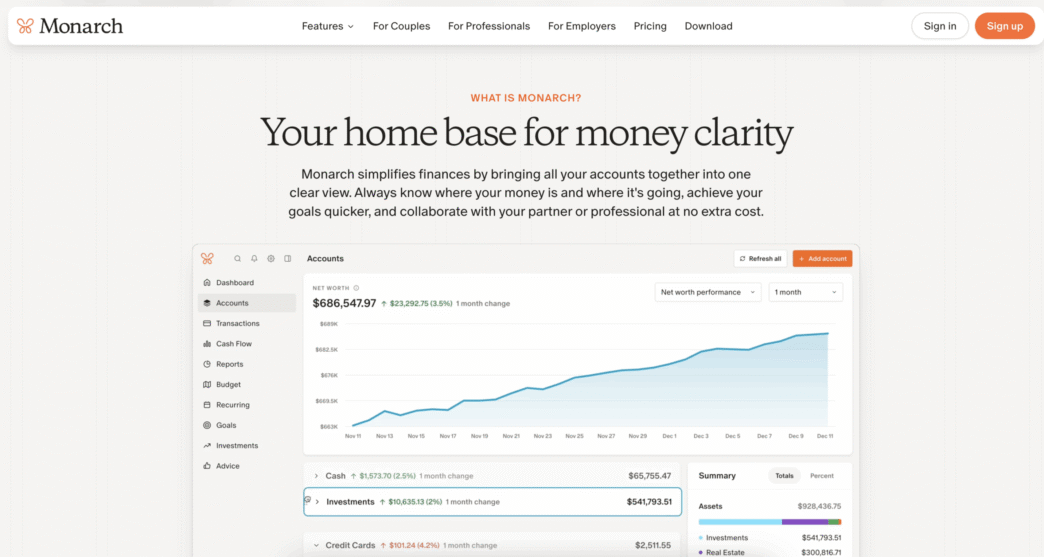

I first started using Monarch in 2023 and went full-time with it at the beginning of 2024. After testing and reviewing a lot of budgeting apps over the years, Monarch has been the one that finally stuck.

What stands out most is that the small stuff doesn't pile up.

With other apps, syncing breaks down and little issues add up until the data isn't reliable. Monarch has been the most consistent and efficient of any app I've used, working seamlessly across all my accounts.

A few other things I've come to really like:

- Design that's clean and intuitive – It feels simple to use without losing functionality.

- Rules and categorization that actually help – For example, I auto-tag all medical expenses. That way I can quickly see totals at tax time.

- Great for tracking, not overcomplicating – I used Simplifi and Empower in the past, but syncing and workarounds made them frustrating. YNAB is excellent if you need strict budgeting, but I mainly use Monarch as a clear dashboard to keep tabs on spending and overall finances.

For me, Monarch “just works.” It gives me reliable, organized data so I can focus on managing money, not troubleshooting software.

To learn more, here's my full review: Monarch Money Review.

Yes. Monarch currently offers a promo code for 50% off your first year when you sign up for the annual plan with code MONARCHVIP. Once you become a member, you also get access to a referral program — your friends can save 50% on their first year, and you'll receive a $30 gift card when they join.The link on this page is through my affiliate relationship with Monarch. It's not the same as the referral program you'd get once you're a member. If you already know someone who uses Monarch, you can ask them to text you their referral code and both of you can benefit.

Not directly. Monarch allows only one promo code at a time. However, sometimes you can find Monarch offers through shopping portals or cashback sites. For example, I've seen it appear on Capital One Shopping, though I haven't personally seen it on Rakuten or other cashback portals. These deals change often, so it's worth checking if you want to try stacking extra savings.

You first start with a 7-day free trial. Once you've created your account, go to Manage Subscription in your settings, select the annual plan, and enter the code MONARCHVIP. You won't be billed until the free trial ends, and then the price will be reduced to $49.99 for the first year. If you sign up through the app, you'll need to subscribe via Apple Pay or Google Play, then go to your account settings to apply the code.

Yes. Every new user gets a 7-day free trial before being charged. This gives you time to explore the app and test the features before committing.

How does Monarch compare to Empower, Simplifi, and YNAB?

Some quick thoughts on each:

- Empower (formerly Personal Capital): Great for investment tracking, but I've found the budgeting features limited. Read my Empower review.

- Simplifi: Despite the name, I found it too complicated and unreliable — syncing often broke, and I had to use workarounds.

- YNAB: Excellent if you want a hands-on, zero-based budgeting lifestyle. But it's a bigger commitment than most people want

For me, Monarch is the right balance: a clean dashboard, reliable syncing, and a simple way to keep tabs on spending and net worth.

Is Monarch Money worth the price?

In my experience, yes. I started using Monarch in 2023, went full-time in 2024, and I plan to keep renewing.

My wife and I use the shared account feature, which lets us both see transactions, set alerts, and stay on the same page. It makes budgeting part of our regular financial conversations without being stressful.

If you're looking to cut every dollar, YNAB may be a better fit.

But if you want a reliable, all-in-one dashboard that helps you track spending and net worth, Monarch is the best app I've used.