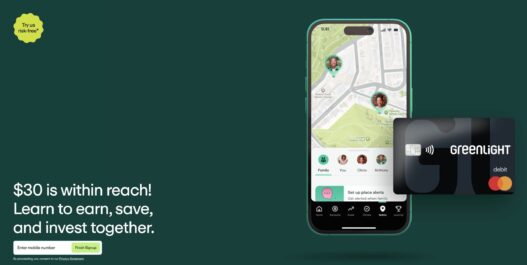

Greenlight is offering a $30 bonus to new members who sign up through a referral link and actively use the platform for 35 days after paying their first monthly subscription fee.

To qualify for the bonus, you must use a referral link from an existing Greenlight customer when you sign up. Only one promotional code can be used during registration, so if you apply another discount code during signup, you won’t be eligible for the referral bonus.

| Referral link: | Greenlight referral link. |

| What you get: | $30 bonus. |

| When: | Within three business days after meeting the requirements. |

| Requirements: | Pay at least one monthly fee and use Greenlight for 35 days. |

While Greenlight charges a monthly subscription fee, they offer a 30-day free trial to test the platform. Plans range from $5.99/mo to $19.98/mo based on the features included. All Greenlight plans are eligible for the referral bonus.

My Experience With Greenlight

I recently started using Greenlight with my three kids (ages 13, 10 and 6). Previously, I used Capital One’s free checking account, which worked fine for basic banking but lacked the comprehensive financial education tools I wanted, especially investing.

While I don’t typically like paying banking fees (we’re on the Max Plan at $10.98/month), I decided Greenlight’s monthly fee was worth it for my specific goals around teaching money management and investing.

We established a system where I allocate 25% of any money they earn toward investing. Right now I have to do this manually each time, and I wish it were more automated, but it’s working well as we establish good financial habits.

I initially considered Acorns for teen accounts and even signed up, but canceled after finding their setup too complicated.

After they acquired GoHenry in 2023, they’re trying to merge the two platforms, which made the experience confusing.

After researching various options in the family finance space, Greenlight offers the most comprehensive suite of capabilities for parents who want to actively teach their children about money management.

I’ll have a full review once we’ve used the platform longer. If you sign up using my referral link, I appreciate you supporting the site.