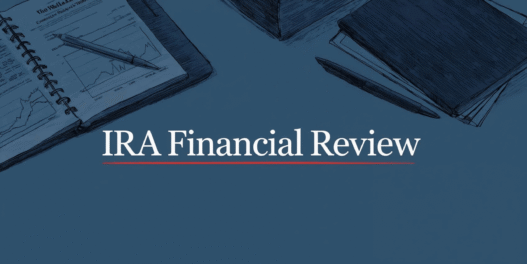

With many self-directed IRA platforms specializing in just one area such as cryptocurrency or precious metals, IRA Financial stands out for its breadth.

Whether you want to invest in real estate or startups, set up a Solo 401(k) for your business, or have checkbook control, IRA Financial allows you to manage it all in one place.

In this IRA Financial review, I'll share who I believe this platform is best suited for and who may be better served by other options.

IRA Financial offers one of the broadest selections of self-directed account types, including custodial and checkbook control IRAs, Solo 401(k)s, HSAs, Coverdell ESAs, and ROBS. Its all-in-one setup is best suited for experienced investors who are already comfortable sourcing and managing private real estate, small business, or private credit deals and who understand the due diligence, compliance, and liquidity trade-offs that come with alternative assets.

IRA Financial also offers a low-cost platform for crypto IRAs, with flat annual fees and direct asset ownership.

Pros

- Optional in-house compliance support, including tax filings and BOI reporting (first year free, $299 after)

- Offers both crypto and traditional alternative assets (real estate, private equity, etc.)

- Secure crypto custody via Bitstamp with cold storage and 1:1 asset backing

Cons

- Higher setup fees than some competitors

- No dedicated account managers

- Better for DIY investors who source their own deals vs. platforms offering pre-vetted investment partnershipsRetryClaude can make mistakes. Please double-check responses

What Makes IRA Financial Different

I've reviewed a lot of self-directed IRA platforms, including crypto IRAs and gold IRAs, and looked closely at how these accounts actually work.

I'll cover the basics below, but first, here's what I found sets IRA Financial apart from its competitors.

#1. Broad Range of Account Types

What stood out most in researching IRA Financial is the variety of account options.

In addition to standard self-directed IRAs, you can choose between custodial and checkbook control for IRAs, Solo 401(k)s, HSAs, Coverdell ESAs, and Rollovers as Business Startups (ROBS) plans.

Very few providers offer both Solo 401(k)s and checkbook control IRAs in one place, and even fewer also support tax-advantaged accounts like HSAs and Coverdell ESAs.

For investors who want to manage multiple accounts, such as a self-directed IRA and a Solo 401(k), under one roof, IRA Financial is one of the few platforms that makes it possible.

#2. Flat-Fee Structure

IRA Financial uses a flat-fee model across all account types, which can be cost-effective for investors with higher balances.

For example, their annual fee of $495 on a self-directed custodial IRA equals 1% of a $49,500 account. As your balance grows, your effective cost goes down.

Keep in mind that with custodians who charge asset-based fees, such as 0.75% per year, you're not just paying on your current balance, but also on future growth.

If your account doubles over time, so do your fees.

#3. IRA In-House Tax Filing, IRS Reporting, and BOI Reporting

Managing a Self-Directed IRA isn't simple. Most custodians offering checkbook control accounts leave compliance entirely up to you. That means often hiring outside CPAs or legal help.

One thing that sets IRA Financial apart is their in-house expertise. For an additional $299 per year after a free first year, clients can opt into an Annual Compliance Service.

It includes unlimited access to specialists in SDIRA tax law, help with complex issues like UBTI and prohibited transactions, and preparation of key filings such as Form 1065 and 990-T — plus BOI reporting for checkbook IRAs.

Company Fundamentals and Facts

| Category | Details |

| Accounts for Individual Investors | Self-Directed IRA, Checkbook IRA, Self-Directed HSA, Self-Directed Coverdell, IRAfi Crypto |

| Accounts for Business Owners | Solo 401(k), ROBS , SEP IRA, SIMPLE IRA |

| Cryptocurrency Platform | Bitstamp exchange; actual crypto ownership (not ETF shares); $100/year flat fee, 46 total cryptocurrencies |

| Account Minimums | No minimums required |

| Prohibited Investments | IRS standard restrictions: collectibles, life insurance in IRAs, transactions with disqualified persons |

| Tax Support Included | Annual 1099-R and 5498 forms |

| Setup & Transfer Timeline | Account opening: 1-3 days • Transfer processing: 3-5 days • Fund receipt: varies by current custodian • Rush options: $75 (2-day) or $200 (1-day) |

| Support Model | Phone, email, and chat support; no dedicated account managers |

Founded in 2010 by Adam Bergman, IRA Financial Group is a self-directed IRA custodian that allows investors to hold alternative assets in tax-advantaged retirement accounts.

Unlike traditional 401(k) providers or brokerages limited to publicly traded securities, IRA Financial facilitates IRS-compliant ownership of assets such as real estate, private businesses, and precious metals. While not a fiduciary, the firm gives investors full control over their investments within IRS guidelines.

Currently, IRA Financial has over $4.1 billion in assets under management across 24,000+ clients nationwide,

According to founder Adam Bergman, in an interview with Brave New Coin, the top five investment categories chosen by clients are:

- Real estate-related investments (60%+ of transactions, according to interview)

- Private business investments

- Credit and debt funds

- Precious metals

- Cryptocurrency

Custodial vs. Checkbook Control With custodial control, you invest through the IRA provider's approved platforms or partners. You don't need approval for each transaction, but your investment options are limited to what the provider supports. Checkbook control gives you full flexibility by letting you manage an IRA-owned LLC or Solo 401(k) yourself. You can write checks, wire funds, or invest in nearly any IRS-approved asset. This approach offers maximum freedom but also means more personal responsibility to stay compliant and manage risk.

IRA Financial Fee Structure

IRA Financial uses a flat-fee model. Instead of charging a percentage of assets like many custodians, their pricing stays fixed regardless of account size.

| Account Type | Setup Fee | Annual Fee |

| Individual Accounts | ||

| — Self-Directed IRA (Custodian Control) | $0 | $495 |

| — Checkbook IRA (IRA LLC) | $999 | $495 |

| — Self-Directed HSA | $0 | $120 |

| — Self-Directed Coverdell ESA (Custodian Control) | $0 | $120 |

| — Self-Directed Coverdell ESA (Checkbook Control) | $999 | $120 |

| — IRAfi Crypto | $0 | $100 |

| Business Owner Accounts | ||

| — Solo 401(k) | $999 | $399 |

| — ROBS 401(k) | $3,500 | $1,200 |

| — SEP IRA | $0 | $495 |

| — SIMPLE IRA | $0 | $495 |

Crypto IRA Trading Fees

On the crypto trading side, IRA Financial charges a flat $100 annual fee for its IRAfi Crypto™ platform, which covers custody and account maintenance, plus a 1% fee on each crypto trade executed on the Bitstamp exchange.

Other Fees

Beyond IRA Financial's setup and annual fees, and separate from any fees your actual investments may charge, there are several other costs to factor in, some optional and some dependent on your location and investment choices.

- State-Specific LLC Costs: If you opt for checkbook control through an LLC, state fees vary dramatically. California charges $800 annually plus gross receipts fees, while Colorado charges just $25, and Arizona has no annual requirements. These are paid directly to the state, not IRA Financial.

- Optional Services: The annual compliance service runs $299 after the first free year, providing tax filing assistance and IRS compliance support.

- Transaction-Specific Fees: According to their fee schedule, certain transactions carry additional charges: $250 for account termination, $25 for outgoing wire transfers, $30 for returned items, and $35 for past-due annual fees. Rush processing costs $75 for 48-hour service or $200 for 24-hour service. In their FAQ, they note that transaction fees may apply for complex or frequent investments.

- Tax Filing Requirements: Multi-member LLCs (owned by two or more IRAs) must file IRS Form 1065 partnership returns, potentially requiring professional tax preparation assistance beyond what IRA Financial provides.

These costs can add several hundred to over a thousand dollars annually to your retirement account expenses, depending on your state and how you use the account.

Important to know. Keep in mind that these are only the fees paid to IRA Financial. Some private investments held within a self-directed IRA, such as real estate partnerships, credit funds, or private equity, often charge their own fees. These may include annual management fees, performance-based fees, or profit sharing. While IRA Financial's flat fee can offer value, your total costs may still be significant depending on the investments you choose.

Security, Safety, and Insurance

IRA Financial operates as a South Dakota-chartered non-bank trust company and licensed IRA custodian under IRS Section 408. This means it's subject to ongoing oversight by the South Dakota Division of Banking, including strict requirements for:

- Capitalization and solvency

- Cybersecurity and anti-money laundering protocols

- Annual audits and compliance reporting

Cash Holdings & Insurance:

- Uninvested cash is held in FDIC-insured omnibus accounts through Capital One Bank, up to the $250,000 per depositor limit.

- Once funds leave the account for an investment, they are no longer covered by FDIC insurance.

- Funds held inside a self-directed IRA are not insured, except for any cash held in FDIC-insured accounts like those at Capital One.

Data Protection:

- Client information is secured with encrypted servers, multi-factor authentication, and real-time account access via IRA Financial's mobile app.

Crypto Security:

- IRA Financial partners with Bitstamp, a regulated exchange overseen by the NYDFS.

- Bitstamp stores 95% of crypto in offline, bank-grade vaults and carries insurance on cold wallets.

- Funds are held 1:1 in custody and are never lent or staked without explicit consent.

IRA Financial Crypto Security Incident (2022)

In February 2022, IRA Financial suffered a major security incident involving accounts custodied on the Gemini exchange.

More than $35 million in client funds were stolen due to vulnerabilities in how IRA Financial's systems managed access and controls. While Gemini itself wasn't directly breached, the platform was used to execute the unauthorized transactions. A lawsuit followed, and according to Cointelegraph, a settlement was eventually reached between Gemini and IRA Financial.

For more background, you can read additional reporting on this incident here:

IRA Financial Competitor Comparison

IRA Vs. ITrustCapital

iTrustCapital focuses mainly on crypto IRAs but also offers precious metals like gold and silver. It provides access to over 75 different cryptocurrencies for trading, giving investors a broad range of options.

Unlike IRA Financial's flat-fee model, iTrustCapital charges no annual account fees on crypto holdings and instead applies a 1% trading fee per transaction, plus the bid/ask spread.

This fee structure often makes iTrustCapital more cost-effective and accessible for beginners and smaller investors, particularly those not rolling over large balances or who just want a place to hold crypto.

With IRA Financial, if your goal is to trade crypto using a private wallet and transact directly on chain, you can set up a Checkbook Control IRA.

The process starts by opening a Self-Directed IRA that forms an LLC owned entirely by the IRA. You, as manager of the LLC, can then open an exchange account in the LLC's name or use a cold wallet held in the LLC's name.

This structure allows you to trade through the LLC and maintain custody of digital assets in a compliant way, while keeping everything clearly separate from your personal accounts.

For more details, see our full iTrustCapital review.

IRA Financial vs. Rocket Dollar

Rocket Dollar is a newer self-directed IRA and Solo 401(k) provider.

Unlike IRA Financial, Rocket Dollar does not offer other tax-advantaged accounts like HSAs, Coverdell ESAs, or ROBS plans, making its account variety more limited.

Rocket Dollar partners with a wider range of alternative investment platforms, offering investors access to many real estate, startup, cryptocurrency, and private equity opportunities.

Fees between Rocket Dollar and IRA Financial often go back and forth depending on account type and size.

The price comparison between the two platforms is as follows:

| Feature | IRA Financial | Rocket Dollar |

| Setup Fee (IRA LLC) | $999 | $600 |

| Annual Fee (IRA LLC) | $495 | $480 ($40/month) |

| Solo 401(k) Setup Fee | $999 | $600 |

| Solo 401(k) Annual Fee | $399 | $480 ($40/month) |

See our Rocket Dollar Review to learn more.

IRA Financial Vs. Equity Trust Company

Equity Trust, founded in 1974, is one of the largest and most established self-directed IRA custodians with over $70 billion in assets under custody. It offers a wide range of account types and alternative investment options similar to IRA Financial, but uses a tiered fee model that can be more expensive for large balances compared to IRA Financial's flat annual fee.

Final Thoughts on IRA Financial

After comparing IRA Financial to other self-directed IRA providers, my takeaway is that it's best suited for experienced investors who are already comfortable with private investments and want to manage multiple account types from a single platform.

The flat-fee pricing can be a real advantage once your account balance reaches a level where it outweighs the percentage-based fees of other custodians, but it is less compelling for smaller accounts.

Some questions I would ask to determine if IRA Financial is the right fit for you are:

- Is this fee structure right for my account size? The “flat-fee” model is often promoted as a benefit for high-net-worth investors. At an annual fee of $495, IRA Financial's pricing can be advantageous for large portfolios. But, if you're just starting out, the flat-fee structure can translate to a significantly higher percentage of assets consumed by fees.

- Do I actually need a self-directed IRA? A self-directed IRA is only necessary if your investment strategy requires holding alternative assets like real estate or private placements that can't be accessed through traditional brokerages. If your goal is to invest in traditional assets like stocks, bonds, and mutual funds, a standard IRA at a low-cost brokerage is a safer, more stable, and more affordable option.

- Am I prepared to be my own investigator? Self-directed IRA custodians are not fiduciaries and do not vet the legitimacy of the investments you choose. This means the responsibility for due diligence falls entirely on you. You must independently verify the value of any assets and be vigilant against fraud, especially with alternative investments that lack the disclosures of publicly traded securities.

Final Verdict: If your primary goal is to buy and hold cryptocurrency, a platform like iTrustCapital may be a better fit. If you are focused on real estate, private credit, or other illiquid private market investments and you value strong compliance support, IRA Financial is worth considering. The firm also offers unmatched account diversification with Solo 401(k)s, HSAs, and IRAs, making it one of the most versatile providers in the space.

Visit IRA Financial